Trading options is just like trading a stock. Open and close the same position by market order or limit order on the same day of trading. Day trading options fall under the PDT rule for margin accounts under $25,000. A stop-loss or trailing-stop can be exercised on an option the same as a stock.

Day Trading Options

This easy-to-digest guide will show you how a professional of 15 years does it. Simple and to the point, with no nonsense. You may have been searching on how to trade options but get lost in a land of confusion with terms and strategies that do not make any sense.

This shows you how in a point blank approach leaving you satisfied and hopefully coming away with that light bulb moment you’ve been looking for. Let’s get into it…

How To Day Trade Options

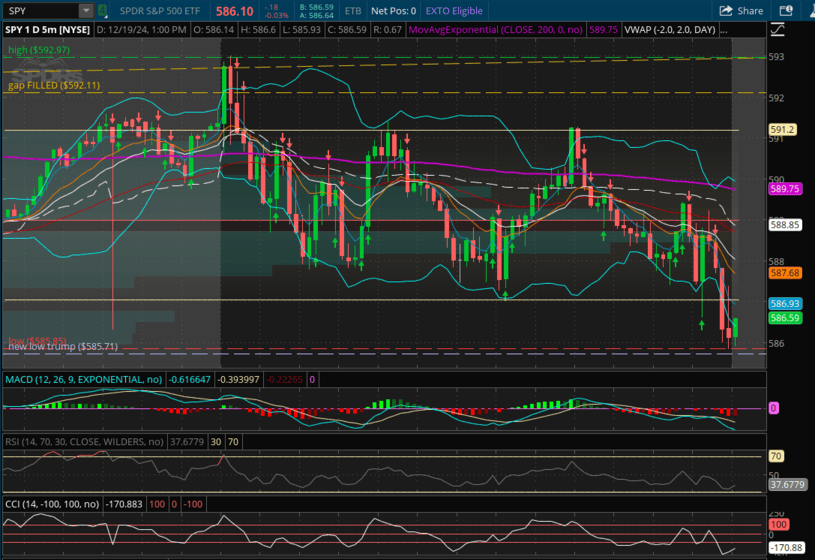

Set up your charts accordingly. Below is a 5-minute chart of the SPY as an example and under the image shown are the indicators that are recommended. All of these indicators paint a picture with each having a purpose. Even when extraordinary events or news hits, they can show the price action and where it may be heading so you can take advantage of it.

1. Main Chart Indicators: (the stock symbol of the option you want to trade).

- Moving average exponential (close, 200, 0, no)

- Moving average exponential (close, 20, 0, yes)

- Moving average exponential (close, 5, 0, yes)

- Moving average exponential (close, 13, 0, no)

- Moving average exponential (close, 50, 0, no)

- Moving average exponential (close, 200, 0, no)

- VWAP (Volume Weighted Average Price)

- Bollinger Bands

- Volume Profile

Below Chart Indicators:

- MACD (12,26,9, EXPONENTIAL, no)

- RSI (Relative Strength Index)

- CCI (Commodity Channel Index)

2. Options Chart: (Option strike price, yes you can input it into a chart)

- VWAP

- Bollinger Bands

- Level 2 on both (see this Bookmap review for a heatmap style of level 2, it’s epic)

- RSI

The chart for the options strike does not need a lot, just those 4 above. Follow the action on the main chart of the stock symbol and use these 4 for added clarification. Watch out for candlesticks piercing the Bollinger Bands as that may be a strong sign of reversal. Same with the VWAP, as the price always makes it back to that point – if it’s overextended it usually makes its way back.

To input the strike price into a chart, simply copy/paste it in there from the options list.

- Look for a negative divergence on the RSI and CCI for the main chart as this is a tell tell sign of a reversal. Be sure to use the 1-hour, 15-minute, 5-minute, and 1-minute charts to show a broader picture. Also, note when a candle is pushed through the Bollinger Band that is a signal of reversal as well. The importance of having several screens showing all this information is crucial.

Knowledge in candlestick patterns also helps, yet they can be tricky because each time frame can show a different picture. All of this makes a “checklist” of when to get in, when to wait, and when to get out.

Keep a watchlist of several option strike prices for the day, both calls and puts so you are ready to switch if the stock price takes a sudden turn in direction. Stay up to date with upcoming news like Fed decisions, earnings reports, etc.

Options Count As Day Trades, Right?

Simply, yes. Opening and closing a position on an option is the same as a stock. The FINRA PTD (pattern day trader) rule applies if you are in a margin account. Cash accounts are different, so consult with your brokerage on that.

- A margin account with $25,000 or more can trade multiple times throughout the day without penalties. A cash account will have a waiting period for money to be released once a trade has been closed.

Before you start diving into options, consider “paper trading” first. This way you can practice and get a feel for the rhythm and flow of how an option strike price relates to the stock it’s connected too. Most brokerages have a feature for paper trading or “on demand”, where you can choose a date in the past and practice that way.

Day Trading vs Options Trading

Key takeaways:

Two popular trading strategies, each with distinct characteristics can be combined as well.

Day Trading:

- Involves buying and selling within the same trading day.

- Relies on volume, momentum, and price movements combined with technical analysis to make quick profits.

- Requires constant monitoring, risk, and fast decision-making.

- Higher frequency of trades, often referred to as scalping.

Options Trading:

- Involves buying or selling options contracts of an underlying asset (stock) at a set price (strike) before expiration.

- Can be used for speculation, income generation, or hedging.

- Offers leverage with less upfront capital but carries a risk of total loss of the premium paid (implementing a stop-loss on the day will minimize this).

- Trades are often longer-term than day trading, but some traders use short-term strategies like 0dte.

Day trading focuses on short-term price movements, while options trading involves leveraging contracts (on an already owned stock) to capitalize on market moves or manage risk.

However, you do not need to own the stock itself to buy and sell their option contracts. Day trading options can involve many different scenarios that include; iron condors, vertical spreads, strangles, etc. Those types of trades are more technical and meant for a longer term. If you want to just buy or sell an option itself, then naked options are what is similar to day trading stocks.

Best Stocks For Options Day Trading

For 0dte (zero day to expiration) there is SPY and QQQ. They offer same-day expiring options every day. This makes day trading options have the most profitable outcome as well as the fastest way to blow your account if you’re not careful in a short period of time.

The popular FAANG stocks like The Magnificent 7: Alphabet (Google), Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla are great to day trade, the closer their option gets to expiring the more volatile it becomes due to theta decay. Recommended to use strikes ITM (in the money) or just OTM (out the money).

The weekly option strike prices of the FAANG’s (Monday – Friday) start off slow at the beginning of the week then increase in volatility on the expiration day. Simply put, trading on a stock’s strike like AAPL on a Friday is similar to trading 0dte options on SPY or QQQ any day of the week. The price swings can vary throughout the day.

Trading Options On Expiration day

Also known as expiration day trading, involves buying or selling options contracts on the day they expire. This involves high risk, and high reward as options are most volatile on expiration day as their time value diminishes rapidly.

Potential for significant gains or total loss is especially for out-of-the-money strike prices as they lose their remaining time value (theta decay) quickly, impacting prices as the end of the day nears.

Risk of Assignment:

- In-the-money (ITM) options can be assigned to you unexpectedly for the corresponding stock at 100 shares of their current price. So if you do not have the capital to cover that, best to get out of that option before the time of expiration.

Liquidity or lack of buyers and sellers can affect trade execution. When level 2 gets overwhelmed with traders trying to close their position and no one to buy them back, that’s where things get dicey. This happens when a strike is far out of the money (OTM) towards the end of the trading day.

Requires fast decision-making and precise execution due to extreme volatility. It is highly recommended to always have a stop-loss trigger in place.

This type of day trading can be lucrative but is highly speculative and requires expertise, discipline, the ability to manage risk effectively, and some guts.

Options Day Trading Rules

This question keeps coming up, “does pattern day trading apply to options?” Yes, Pattern Day Trading (PDT) rules apply to options trading. So it’s important to be repetitive here so there is NO question about it.

A pattern day trader is someone who executes three or more day trades (buying and selling the same security, including options, within the same day) in a rolling five-business-day period in a margin account.

To day trade options (or stocks) under PDT rules, you must maintain a minimum account balance of $25,000 in your brokerage margin account.

Falling below the $25,000 threshold while engaging in pattern day trading can result in account restrictions or suspension. Again, consult with your brokerage about any specifics.

Alternatives:

- Use a cash account (PDT rules don’t apply, but funds are subject to settlement delays).

- Limit day trades to three or fewer in five business days to avoid PDT classification.

- If you’re trading options frequently, be mindful of PDT rules to avoid restrictions and ensure compliance.

Best Broker For Options Day Trading

For day trading platforms, there are 3 that stand out at the moment. The main things to look for is speed, load, and reliability.

These are the top 3

- Tastytrade: Very fast and lightweight platform with a lot of options for desktop, mobile, and tablet. See our tastytrade review here.

- Robinhood: Like tastytrade, they offer a lightweight and ultra-fast platform as well. Plus they are popular amongst younger traders. See our Robinhood review here.

- Charles Schwab (formerly TD Ameritrade): A powerhouse of a platform, their ThinkorSwim platform is top-notch. The biggest con for them is that it’s a heavy load, so a computer with lots of power works best while using it.

Many have asked, can you day trade options on Robinhood? Of course, you can. Remember the Gamestop chaos from a few years ago? That “RouringKitty” fella uses Robinhood and put them on the trading options map.

Common Questions and Answers

Below are common inquiries when it comes to day trading related to options.

Does options trading count as day trading?

- Only if you open and close your position on the same trading day. Sometimes holding overnight can count as a day trade as well, check with your brokerage for the rules regarding that.

Are day trading options profitable?

- Yes! This 0dte options post is just an example, as there are many more on this site to check out. Keep in mind day trading options is very risky, but yes nice profits can be made once you know what you’re doing and accept the risks.

Does pattern day trading apply to options?

- Yes it does, as explained above. Follow and familiarize yourself with the FINRA rules.

Summary:

In conclusion, day trading options is a lucrative and fast-paced environment as well as a stressful one to boot. Using multiple monitors and the indicators mentioned will hopefully help in your trading journey. Gauge the market, find a stock that has some movement, choose an option strike price, and wait for entry.

Set stop loss triggers and move like water if that one is not working out. It’s OK to find another stock or strike if there is no action as it’s part of the game along with losses, even the best traders take a loss from time to time.

There is a reason trading options are popular as the profits can be big in a short period of time. Just know the risks and trade smart, not hard.

[This post is an opinion, not advice. Consult with our local trading rules association for more information.]

If you enjoyed this, please consider sharing below.

> Recommended: brokerage for trading > tastytrade.com.

> Recommended: order flow heatmap > bookmap.com.