Day trading SPY options has become a favored strategy for many traders seeking to capitalize on the volatility and liquidity of the S&P 500. The SPY represents an index of 500 large-cap American stocks, making it one of the most liquid markets for options trading. Here’s a detailed guide on how to effectively day trade SPY options, including strategies, tools, and tips to enhance your trading success.

SPY Options Trading Strategy

SPY options are derivative contracts that give traders the right, but not the obligation, to buy (call options) or sell (put options) shares of the SPY ETF at a specified price (strike price) before the option’s expiration date. These options are highly liquid, making them a favorite choice among day traders looking for quick trades.

Understanding SPY Options

Before diving into the trading strategies, it’s crucial to understand what SPY options are.

- Definition: SPY options are derivative contracts that give traders the right, but not the obligation, to buy or sell SPY shares at a specific price before or at expiration.

- Liquidity: They are known for their high liquidity, which allows for easy entry and exit from positions with minimal slippage.

- Volatility: The SPY can experience significant intraday moves, offering numerous opportunities for profit in a short time frame.

Benefits of Trading SPY Options

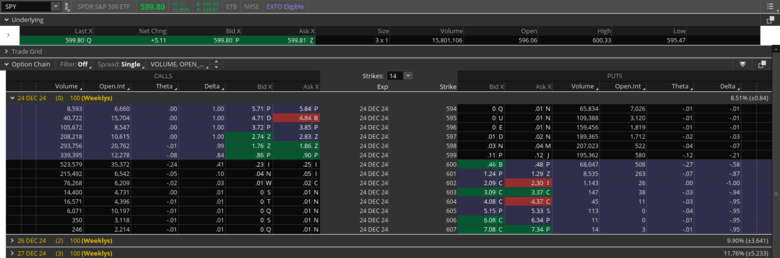

- High Liquidity: SPY options are among the most traded options contracts, ensuring tight bid-ask spreads.

- Flexibility: With expirations available every Monday, Wednesday, and Friday, as well as 0dte (daily) traders can tailor their strategies to short-term market movements.

- Diversification: Since SPY tracks the S&P 500 index, trading SPY options allows traders to speculate on the broader market instead of individual stocks.

- Leverage: Options provide the ability to control a large amount of SPY shares with a relatively small capital investment.

Steps to Day Trade SPY Options Successfully

1. Understand the Basics of Options Trading

Before trading SPY options, it’s crucial to understand how options work. Familiarize yourself with these key terms.

- Strike Price: The price at which the underlying SPY shares can be bought or sold.

- Premium: The cost of purchasing the option.

- Intrinsic Value: The difference between the SPY’s current price and the option’s strike price.

- Time Decay (Theta): The loss in the option’s value as it approaches expiration.

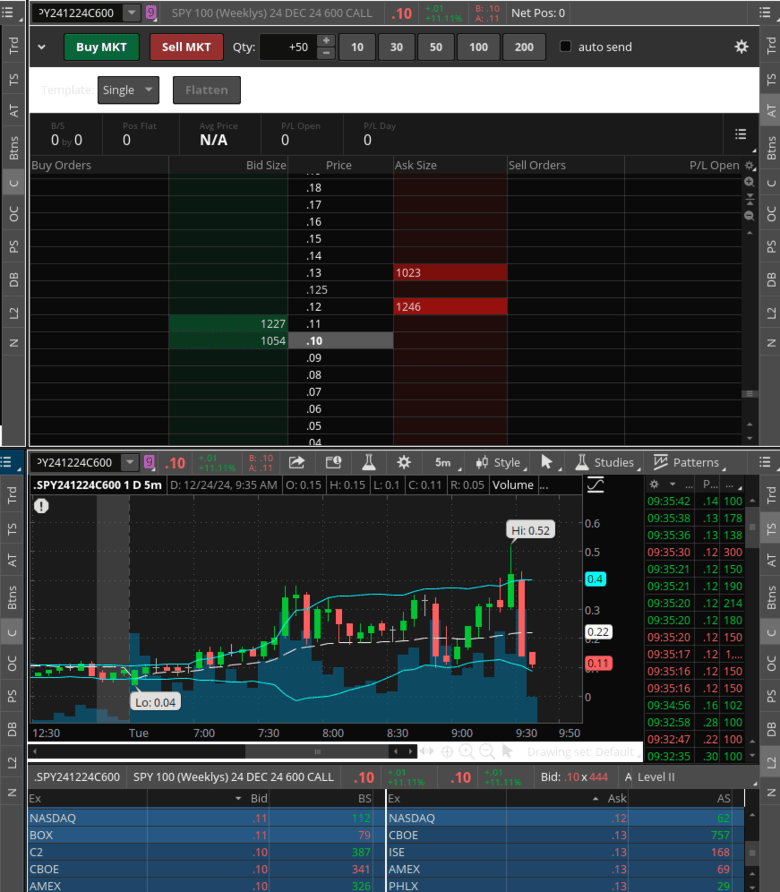

2. Set Up a Reliable Trading Platform

Choose a trading platform that offers real-time data, advanced charting tools, and low commissions for options trading. Platforms like TastyTrade, Interactive Brokers, and Robinhood are popular among options traders.

3. Develop a Day Trading Strategy

A well-defined trading strategy is essential for success. Below are some commonly used strategies for trading SPY options.

- a. Scalping

Scalping involves making quick trades to capture small price movements. Traders using this strategy often trade at high frequency, aiming for incremental profits that accumulate over time.

- b. Momentum Trading

This strategy focuses on trading options based on strong price trends or significant market events. Traders look for breakouts or breakdowns and enter trades in the direction of the momentum.

- c. Reversal Trading

Reversal trading involves identifying overbought or oversold conditions and anticipating a price reversal. Indicators like Relative Strength Index (RSI) and Bollinger Bands can help pinpoint reversal opportunities.

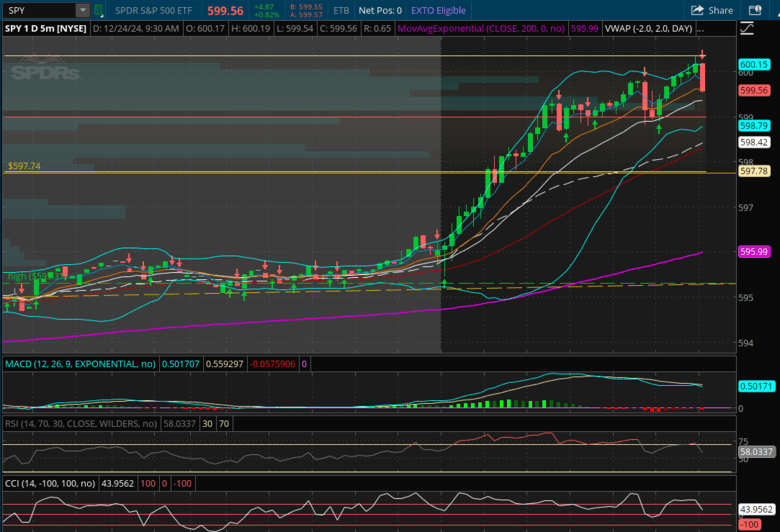

4. Use Technical Analysis

Technical analysis is a cornerstone of day trading. Key indicators to watch when trading SPY options include the following…

- Moving Averages: To identify trends and potential reversal points.

- Volume: To confirm the strength of a price movement.

- MACD (Moving Average Convergence Divergence): To spot changes in momentum.

- CCI Commodity Channel Index (CCI): measures the difference between current price & historical average price.

- Fibonacci Retracements: To identify support and resistance levels.

5. Manage Risk Effectively

Risk management is critical in day trading. Consider the following practices:

- Position Sizing: Limit the amount of capital allocated to a single trade to avoid significant losses.

- Stop-Loss Orders: Set predefined exit points to minimize losses.

- Risk-Reward Ratio: Aim for a ratio of at least 1:2 to ensure potential profits outweigh risks.

6. Monitor Market Conditions

The SPY ETF is influenced by these macroeconomic factors.

- Economic Data Releases: Reports like non-farm payrolls, inflation data, and GDP growth can cause significant market volatility.

- Federal Reserve Policy: Interest rate decisions and monetary policy statements often impact the SPY ETF.

- Global Events: Geopolitical developments, such as trade disputes or crises, can affect the broader market.

7. Avoid Over trading

Over-trading can lead to unnecessary losses and emotional decision-making. Stick to your trading plan and avoid entering trades without a clear setup.

Example Trade: Scalping SPY Options

- Setup: Assume the SPY ETF is trading at $420, and you anticipate a short-term upward move based on bullish momentum.

- Entry: Buy SPY call options with a strike price of $422 and an expiration date three days away.

- Execution: As the SPY ETF rises to $423, the call options gain value. You sell the options to lock in profits.

- Exit: Exit the trade quickly to avoid the effects of time decay and potential reversals.

Common Mistakes to Avoid

- Ignoring Time Decay: Holding options too long can erode their value.

- Over-leveraging: Trading with excessive position sizes can lead to significant losses.

- Chasing Trades: Entering trades out of fear of missing out (FOMO) often results in poor decisions.

- Lack of Discipline: Deviating from your trading plan increases the risk of losses.

Strategies for Day Trading SPY Options

1. Scalping

- Concept: Focus on small price changes for quick profits.

- Execution: Buy options when the SPY is at or near key support levels and sell when it reaches resistance, or vice versa during bearish trends.

- Key Metrics: Pay attention to volume, VWAP (Volume Weighted Average Price), and short-term moving averages.

2. Momentum Trading

- Concept: Capitalize on the continuation of existing trends.

- Execution: Look for strong breakouts from consolidation patterns or news-driven movements. Enter long calls or put options based on the direction of the momentum.

- Tools: Use RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) to identify momentum.

3. Iron Condor

- Concept: A strategy for when you predict low market volatility.

- Execution: Sell an out-of-the-money (OTM) call spread and an OTM put spread simultaneously. This profits if the SPY stays within a specific range.

- Risk Management: Ensure the wings of your spread are wide enough to account for unexpected large moves.

4. Straddles and Strangles

- Concept: Bet on volatility rather than direction.

- Execution: Buy both a call and a put at the same strike price (straddle) or different strike prices (strangle), expecting a significant move in either direction.

- Timing: Ideal during earnings announcements or major economic reports.

5. Butterfly Spread

- Concept: A neutral strategy that benefits from minimal price movement in the underlying asset.

- Execution: Buy one in-the-money (ITM) call, sell two at-the-money (ATM) calls, and buy one out-of-the-money (OTM) call, all with the same expiration but different strikes. The goal is for SPY to close at the middle strike at expiration.

- Advantages: Limited risk with a known maximum loss; potential for profit if SPY remains stable.

6. Calendar Spread

- Concept: Capitalize on the difference in time decay between options with different expiration dates.

- Execution: Sell a short-term option and buy a longer-term option with the same strike price. This can be done with calls or puts.

- Key Points: Works best when the market is expected to have a short-term dip or rise but then revert to the strike price at the longer expiration.

7. Reverse Iron Condor

- Concept: Bet on volatility rather than the lack thereof, opposite to the standard Iron Condor.

- Execution: Buy an OTM call spread and an OTM put spread. This strategy profits if there’s a significant move in either direction past the short strike prices.

- When to Use: Before major announcements or when you expect increased market volatility.

8. Synthetic Long Stock

- Concept: Mimic the payoff of owning the stock without actually buying it.

- Execution: Buy an at-the-money call and sell an at-the-money put with the same expiration. This strategy simulates owning the stock but with leverage.

- Risk: Substantial, as you could face unlimited losses if the SPY price drops significantly.

9. Gamma Scalping

- Concept: Take advantage of the gamma (rate of change in delta) of options by adjusting the delta of your position throughout the day.

- Execution: When you own options, as the underlying SPY moves, you buy or sell shares of SPY to maintain a delta-neutral position. Profit comes from the adjustments if the SPY price moves significantly.

- Complexity: Requires active management and understanding of options’ Greeks, especially gamma and delta.

10. Breakout Trading with Options

- Concept: Trade on breakouts from established price ranges using options for leverage.

- Execution: Buy calls if breaking above resistance or puts if breaking below support. Use technical indicators like

Bollinger Bands or ATR (Average True Range) to identify potential breakouts. - Risk Management: Use stop-losses in case the breakout fails.

11. Divergence Trading with Options

- Concept: Use divergences between price action and momentum indicators for entry points.

- Execution: If SPY’s price is making new highs but the RSI or MACD isn’t, this could signal a potential reversal.

Buy puts in anticipation of a downturn or calls if expecting a bounce back after a divergence in a downtrend. - Caveats: Divergences can be misleading, so they should not be the sole basis for trading decisions.

12. Pairs Trading with Options

- Concept: Exploit the spread between SPY and another highly correlated asset like QQQ (Nasdaq 100 ETF).

- Execution: If you predict one will outperform or under-perform the other, you could go long calls on one and long puts on the other.

- Considerations: Requires monitoring of both assets closely due to the potential for rapid changes in correlation.

Practical Considerations for These Strategies

- Liquidity: Always check the liquidity of the options you’re trading. Low liquidity can lead to poor execution prices.

- Volatility: Some strategies perform better in high or low-volatility environments; adjust your strategy based on the VIX (Volatility Index).

- Risk Management: Each strategy should be coupled with a clear exit strategy, whether it’s a stop-loss or a target profit level.

- Continuous Learning: Each strategy has its nuances; understanding when and how to apply them is key to success.

These strategies provide a broad spectrum of approaches to day trading SPY options, catering to various market conditions and risk profiles. Remember, effective trading involves not just strategy selection but also meticulous risk management and a continuous learning mindset. Learn to use your brokerage’s “Active Trader” as it comes in handy for day trading the SPY.

Tools and Platforms

- Trading Platforms: Opt for platforms like Thinkorswim, or TastyTrade, or Robinhood that offer real-time data, advanced charting, and the ability to manage complex options strategies.

- Analytical Tools: Use tools like Bollinger Bands, Fibonacci retracements, and candlestick patterns for better entry and exit points.

- Risk Management Software: Tools that can automatically set stop-losses or take-profit orders are crucial in managing risk.

- Bookmap: Deeper insights into level 2 using a heatmap style. (a MUST!) Review of Bookmap here.

Key Considerations for Day Trading SPY Options

- Time Decay: Options lose value as they approach expiration. Focus on short-dated options to minimize this effect but be prepared for rapid price movements.

- Market Hours: SPY options trading volume peaks during U.S. market hours, particularly in the first and last hour of trading. These times can offer the best opportunities for day traders.

- Leverage: While leverage can amplify gains, it also increases potential losses. Manage your position size to not risk more than you can afford to lose.

Practical Tips for Success

Day trading SPY options can be a lucrative venture for disciplined and knowledgeable traders. By understanding the basics, developing a robust strategy, and practicing sound risk management, you can navigate the complexities of SPY options trading with confidence. Remember, consistent success in day trading requires patience, continuous learning, and adaptability to changing market conditions.

- Education: Never stop learning about market analysis, options pricing models, and economic indicators.

- Practice: Use paper trading to test strategies without financial risk before going live.

- Staying Updated: Keep an eye on market news, especially events like Federal Reserve announcements or economic data releases which can sway the S&P 500 significantly.

- Psychology: Discipline and emotional control are key. Don’t let a string of wins make you overconfident or losses lead to revenge trading.

Conclusion

If you’re starting, consider paper trading or using a demo account to practice your strategies without risking real money. Over time, as you gain experience and refine your approach, you’ll be better equipped to capitalize on the opportunities presented by SPY options. For more detailed info on day trading options see this post.

Day trading SPY options can be exhilarating and profitable if approached with the right strategies, tools, and mindset. By understanding the market dynamics, using appropriate trading strategies, and maintaining strict discipline, you can navigate the complexities of SPY options trading. Remember, success in day trading isn’t just about making profits and managing risks effectively. Keep educating yourself, stay informed, and adapt your strategies to market conditions for long-term success.

Please consider sharing this below.

> Recommended: brokerage for trading > tastytrade.com.

> Recommended: order flow heatmap > bookmap.com.