The Commodity Channel Index (CCI) is a versatile momentum-based oscillator that helps traders identify overbought and oversold conditions, as well as potential trend reversals.

Key Takeaways:

- CCI helps traders spot trends, overbought/oversold conditions, and potential reversals.

- Strategies include trend-following, overbought/oversold, divergence, and moving average combinations.

- It is best used alongside other technical indicators to increase the accuracy of signals.

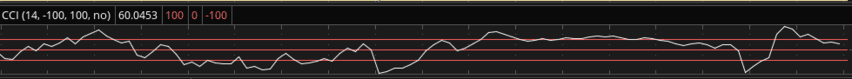

Here’s a snippet of a trading strategy using CCI below.

1. Overbought/Oversold Levels

- Overbought: CCI > +100. Look for potential selling opportunities.

- Oversold: CCI < -100. Look for potential buying opportunities.

2. Entry Signals

- Buy: When CCI crosses above -100, signaling a potential bullish reversal.

- Sell: When CCI crosses below +100, signaling a potential bearish reversal.

3. Divergence

- Bullish Divergence: Price makes lower lows while CCI makes higher lows.

- Bearish Divergence: Price makes higher highs while CCI makes lower highs.

4. Combining with Other Indicators

- Pair CCI with moving averages or trendlines for confirmation of signals.

Pro Tip: Always use stop-loss orders and risk management to minimize losses. CCI works best in conjunction with other technical analysis tools.

Understanding the Commodity Channel Index (CCI)

The Commodity Channel Index (CCI) is a versatile technical indicator used by traders to assess trends, identify overbought or oversold conditions, and find potential reversal points in the market. It was originally designed by Donald Lambert in 1980 to measure the deviation of a security’s price from its average price over a specific period. Since its creation, the CCI has become a staple in the technical analysis toolbox for both short-term and long-term traders.

Key Features of the CCI Indicator

- Range: The CCI can rise above 100 (indicating overbought conditions) or fall below -100 (indicating oversold conditions). However, values can also exceed these limits, signaling strong momentum in the market.

- Zero Line: The zero line represents the point where the typical price equals the moving average, helping traders spot potential trend changes.

- Volatility: CCI can be highly volatile, moving rapidly between overbought and oversold levels, which is why it is often combined with other indicators to confirm signals.

How to Use the CCI Indicator in Trading

The video above shows how the CCI indicator is used, AJ Monte of stickytrades.com is a veteran stock trader and visually explains it’s use.

1. Overbought and Oversold Conditions

- Overbought (Above +100): When the CCI rises above the +100 level, it suggests that the asset is overbought, and a price reversal or pullback may be imminent.

- Oversold (Below -100): When the CCI falls below the -100 level, it indicates oversold conditions, which could signal that a reversal or bounce is likely.

2. Trend Reversals

- Bullish Divergence: When the price makes a new low, but the CCI fails to make a new low (i.e., the CCI is higher than the previous low), this indicates a potential bullish reversal.

- Bearish Divergence: When the price makes a new high, but the CCI fails to make a new high, this suggests a potential bearish reversal.

3. CCI Crossing the Zero Line

- Buy Signal: A crossing above the zero line indicates that the asset has turned bullish, as the price has surpassed its moving average.

- Sell Signal: A crossing below the zero line indicates that the asset has turned bearish, as the price is now below its moving average.

4. Trend Strength

- Strong Trends: If the CCI remains above +100, it indicates a strong bullish trend. Similarly, if the CCI stays below -100, a strong bearish trend is indicated.

- Weak Trends: If the CCI fluctuates around the zero line, it suggests a weak or sideways market.

CCI Trading Strategies

1. The CCI Trend Following Strategy

- Purpose: This strategy aims to identify the direction of the market and ride the trend as long as possible.

- How It Works:

- Enter a long position when the CCI crosses above +100 (indicating a strong upward momentum).

- Enter a short position when the CCI crosses below -100 (indicating strong downward momentum).

- Exit when the CCI starts to reverse or when it crosses the zero line.

2. CCI Overbought/Oversold Strategy

- Purpose: This strategy focuses on identifying overbought and oversold conditions in the market.

- How It Works:

- Enter a long position when the CCI drops below -100 and then crosses back above it (signaling a potential bounce from oversold levels).

- Enter a short position when the CCI rises above +100 and then crosses back below it (signaling a potential reversal from overbought levels).

3. CCI Divergence Strategy

- Purpose: This strategy looks for divergences between price action and the CCI, signaling potential reversals.

- How It Works:

- Enter a long position when there is a bullish divergence (price makes new lows, but the CCI makes higher lows).

- Enter a short position when there is a bearish divergence (price makes new highs, but the CCI fails to make new highs).

4. CCI + Moving Average Strategy

- Purpose: This strategy combines the CCI with a moving average to filter out false signals and confirm trend direction.

- How It Works:

- Enter a long position when the CCI crosses above +100 while the price is above the moving average (indicating a strong bullish trend).

- Enter a short position when the CCI crosses below -100 while the price is below the moving average (indicating a strong bearish trend).

Advantages of the CCI Indicator

- Flexibility: The CCI can be used for various timeframes, from intraday to long-term trading.

- Early Signal Detection: The CCI often provides early indications of trends or reversals, allowing traders to enter positions early.

- Momentum-Based: As a momentum oscillator, it helps traders stay with the trend until signs of exhaustion emerge.

Limitations of the CCI Indicator

- False Signals: The CCI can produce false signals, especially during choppy or sideways markets. This is why it’s often combined with other indicators like the RSI to confirm signals.

- Lagging Indicator: Like most technical indicators, the CCI is based on past price action, which can result in delayed signals.

- Overbought/Oversold Conditions: Overbought or oversold conditions don’t always lead to immediate reversals, especially during strong trending markets.

Conclusion

The CCI indicator is a valuable tool in any trader’s arsenal, offering insights into market trends, momentum, and potential reversal points. By using CCI with the right strategy, traders can improve their chances of success, especially when combined with other indicators to filter out false signals. Remember that no indicator is foolproof, and it’s essential to incorporate proper risk management and use multiple tools to confirm trade entries and exits.

> Recommended: brokerage for trading > tastytrade.com.

> Recommended: order flow heatmap > bookmap.com.