In the fast-paced world of trading, I understand that having the right tools can significantly impact success. Bookmap trading software has emerged as a powerful solution, specifically designed to help traders visualize market data and gain deeper insights into price movements.

Visit: https://bookmap.com

Key Takeaways:

- The Bookmap Trading software offers deep insights using a heat-map style to see where large lots of buyers and sellers are located on level 2 and more.

- Use as a stand alone software on your desktop or an option is to integrate Bookmap into your brokerage’s trading software.

This article delves into how Bookmap operates, highlighting its key features and the substantial benefits it offers. From real-time data visualization to advanced order book analysis, I aim to demonstrate how Bookmap can enhance trading strategies across various markets, including stocks, futures, forex, and cryptocurrencies.

This is an opportunity to decode the market that should not be overlooked.

What Is Bookmap Trading Software?

- Bookmap is an innovative trading software that I utilize to enhance my market analysis through real-time data visualization. This powerful tool employs a heatmap to represent liquidity and order flow, enabling me to gain a clearer understanding of price action and make informed trading decisions.

- By integrating advanced trading indicators and technical analysis features, Bookmap allows me to effectively analyze market trends across various trading platforms, whether I am involved in forex trading, futures trading, or cryptocurrency markets.

- The user interface is designed for an optimal experience, making it a preferred choice among professional trading communities, including hedge funds and institutional traders.

How Does Bookmap Work?

I utilize Bookmap to gain a comprehensive view of market depth through its innovative order book visualization. This tool enables me to track liquidity and trade execution speed in real time.

With this functionality, I can effectively assess market sentiment and optimize my trading algorithms based on live market data. By visualizing the liquidity pool and aggregating different order types, I am able to develop precise trading strategies and enhance my overall performance metrics across various financial markets.

What Are the Key Features of Bookmap?

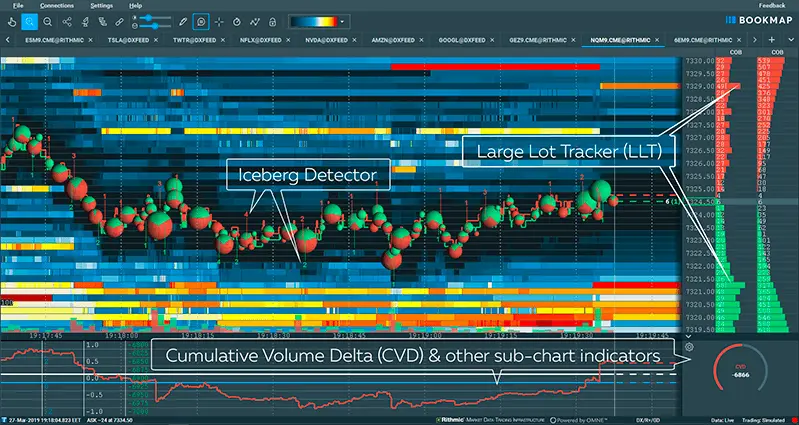

The key features of Bookmap include advanced visual trading capabilities that provide me with a comprehensive understanding of market trends and trading signals. I find the customizable charting tools and trading indicators particularly beneficial, as they assist in developing effective trading strategies and setting up alerts for critical market movements.

![]() The enhanced user experience allows me to navigate the software intuitively, maximizing my engagement with market data.

The enhanced user experience allows me to navigate the software intuitively, maximizing my engagement with market data.

One feature that stands out is the heatmap visualization, which highlights liquidity levels in real-time. This functionality enables me to easily identify support and resistance areas. For instance, when I observe high liquidity zones, I can plan my entries and exits more strategically.

The integration of historical data is another advantage, allowing me to backtest strategies effectively. This capability is especially valuable for new traders seeking to understand the potential outcomes of various approaches.

Additionally, Bookmap’s order flow analytics give me insights into the frequency and size of buy and sell orders, enhancing my understanding of market sentiment and helping me anticipate price movements with greater accuracy.

What Are the Benefits of Using Bookmap?

Utilizing Bookmap provides me with numerous advantages as a trader, including the ability to refine my trading strategies and enhance my risk management techniques through advanced analytics and real-time data.

This software supports my trading performance by allowing me to backtest my strategies, which ensures I am well-prepared for various market conditions. By leveraging these capabilities, I can improve my decision-making processes and achieve better outcomes in my trading endeavors.

1. Real-Time Market Data Visualization

Bookmap’s real-time market data visualization feature enables me to observe market trends and price action as they unfold. This capability allows for immediate analysis of market movements, facilitating quicker decision-making.

The importance of this feature cannot be overstated, as it directly influences trader psychology and market sentiment. By viewing live order flows and liquidity levels, I gain insights into potential reversals or continuations, which enhances my confidence in executing strategies.

For example, if I notice increased buying pressure through this visualization, I may choose to refine my approach, leveraging that momentum to enter a position or set tighter stop-loss orders. Additionally, by understanding the market depth, I can better gauge overall sentiment, allowing me to anticipate volatility and adjust my tactics accordingly.

2. Advanced Order Book Analysis

The advanced order book analysis provided by Bookmap enables me to assess liquidity and market depth effectively, which is essential for ensuring optimal execution speed during trades. By understanding these factors, I am better equipped to anticipate price movements and manage my orders strategically.

Identifying areas of high liquidity allows me to determine the best times to enter or exit positions, maximizing potential gains while minimizing slippage. For example, if I notice significant buy orders accumulating at a specific price level, I view this as an ideal opportunity to place a limit order to buy before the price increases.

On the other hand, recognizing thin liquidity serves as a warning about the potential for price spikes or drops, prompting me to adjust my strategies accordingly. Additionally, I can utilize techniques such as iceberg orders to conceal my true intentions and help maintain market stability, highlighting the importance of mastering order management in volatile conditions.

3. Customizable Dashboard and Alerts

Bookmap’s customizable dashboard allows me to tailor my workspace according to my trading preferences, ensuring that I have quick access to essential market analysis tools and trading alerts. This level of flexibility significantly enhances my overall user interface experience.

Such personalization is vital for maximizing efficiency and optimizing my decision-making in fast-paced trading environments. By setting specific alerts for price movements or market trends, I can stay ahead of fluctuations without the need to constantly monitor charts.

For example, I might configure alerts for key resistance or support levels, enabling me to react promptly when a potential breakout occurs.

Integrating tools like volume heat maps helps me visualize market activity, making it easier to make informed decisions. This adaptability not only saves me time but also enhances my ability to capitalize on opportunities as they arise.

4. Efficient Risk Management

Efficient risk management is fundamental to my success in trading, and I find that Bookmap offers invaluable tools that enhance my ability to size positions effectively and mitigate volatility risks. By integrating robust risk management features into my trading strategies, I can better safeguard my capital.

One essential strategy I employ is the use of stop-loss orders, which serve as a safety net by automatically closing a position once it reaches a predetermined loss threshold. This approach prevents me from facing catastrophic losses that could severely impact my portfolio.

Additionally, I utilize risk-reward ratio calculations to evaluate potential trades before execution, ensuring that the anticipated reward justifies the risks involved. By systematically incorporating these methods into my overall trading plans, I can enhance my decision-making processes and maintain a disciplined approach in volatile markets, ultimately leading to more consistent performance over time.

How Can Bookmap Help Traders Decode the Market?

I utilize Bookmap to enhance my market analysis by gaining deep insights into order flow and identifying potential market imbalances.

By understanding these critical elements, I can improve my trading psychology and ultimately enhance my trading performance.

1. Visualizing Market Depth and Liquidity

Visualizing market depth and liquidity through Bookmap’s heatmap feature allows me to identify where price levels are most populated, providing essential insights into potential support and resistance areas. This visualization creates a dynamic landscape, enabling me to pinpoint where significant buying or selling activity may occur.

By understanding liquidity in this way, I am enableed to devise more informed trade setups by recognizing areas where orders are likely to cluster. This can indicate potential price reversals or continuations. Consequently, I can better anticipate market movements and adjust my strategies accordingly.

Incorporating insights from the heatmap allows me to build confidence in my decisions, optimize my entry and exit points, and enhance my overall trading performance. Ultimately, this leads to a more nuanced understanding of how price action unfolds in real-time.

2. Spotting Market Imbalances and Reversals

Spotting market imbalances and potential reversals is a significant advantage of using Bookmap, as it enables me to identify shifts in market dynamics that could indicate optimal entry or exit points.

By analyzing the real-time heatmap and order book data, I can gain valuable insights into where buying and selling pressure is concentrated. For instance, a sudden spike in liquidity at a specific price level may suggest an impending reversal, indicating that aggressive buying or selling could soon occur.

Utilizing the volume dots feature allows me to highlight changes in market activity over time, providing clues about the strength of specific price movements. Implementing these insights may involve setting buy orders just above a newly identified support level or placing sell orders near robust resistance levels.

By combining these analytical tools with established risk management practices, I can enhance the efficiency of my trading strategy and potentially improve my success rate.

3. Analyzing Order Flow and Execution Patterns

Analyzing order flow and execution patterns with Bookmap allows me to gain a deeper understanding of market sentiment and trader psychology, which ultimately influences my trading decisions.

By exploring real-time data, I can identify significant support and resistance levels through visible liquidity and volume, which is crucial for forecasting potential market reversals. This heightened situational awareness enables me to adapt my strategies effectively, recognizing not just where the price is, but also understanding the reasons behind its movements.

Utilizing these insights allows me to position myself advantageously, making informed decisions about when to enter or exit trades based on predictions of future market movements. By emphasizing the fluctuations in order flow, I can refine my approach, resulting in more effective entries, reduced risks, and, ultimately, improved trading performance.

What Markets Can Be Traded Using Bookmap?

I appreciate that Bookmap supports a diverse array of markets, allowing traders to engage with the stock market, forex trading, futures trading, and cryptocurrency.

This versatility positions it as an effective tool for multi-asset trading.

1. Stocks

When I trade stocks using Bookmap, I have the opportunity to employ various trading strategies that take into account market trends and volatility. The software’s capability to visualize order flow and liquidity is an invaluable asset in this process.

By utilizing real-time data, I can identify significant price levels where buying and selling pressure is evident. For example, when I use the heatmap feature, I can pinpoint areas of high liquidity, which provides insights into potential support and resistance points.

Additionally, the ability to review historical order book data allows me to discern patterns that may help forecast future price movements.

With this information at my disposal, I can effectively anticipate market reactions and make informed decisions about entering or exiting positions at the most opportune times. Implementing these tools not only enhances my overall trading strategy but also contributes to improved performance in the stock market.

2. Futures

Engaging in futures trading with Bookmap allows me to perform comprehensive market analysis and implement effective risk management strategies, all of which enhance my trading performance in volatile markets.

By leveraging real-time data visualization tools and advanced order flow analysis, I can gain deeper insights into market dynamics and make more informed decisions. The heatmap feature is particularly valuable, as it enables me to identify price levels with higher liquidity, thereby highlighting potential support and resistance areas that could influence future price movements.

With the capability to visualize order book data and historical trades, I can better anticipate market trends and proactively adjust my strategies. This level of detail is essential for managing risk effectively and improving my overall trading experience, especially in the fast-paced world of futures trading.

3. Forex

In my forex trading activities, I find that Bookmap offers me valuable insights into currency pairs, enabling me to develop informed trading strategies based on market sentiment and price action analysis.

By utilizing heatmaps and order book data, I can visualize liquidity, identify potential market reversals, and pinpoint areas of support and resistance.

For example, through the analysis of volume clustering, I can determine where significant trading activity is occurring, which helps me anticipate price movements.

Implementing techniques such as scalping or trend-following strategies becomes significantly more effective with Bookmap’s real-time data and dynamic visualization tools.

This enables me to make decisions that are in line with market conditions, ultimately enhancing my ability to navigate the complexities of currency trading successfully.

4. Cryptocurrencies

Engaging in cryptocurrency trading with Bookmap allows me to navigate the high volatility of digital assets effectively, leveraging the software’s capabilities to enhance my trading performance and manage risk.

In this rapidly evolving landscape, where prices can fluctuate dramatically in a matter of moments, it is essential for me to stay ahead of market trends. Bookmap provides real-time visualization of market depth and price action, enabling me to identify critical support and resistance levels. This not only improves my decision-making but also aids in predicting potential price movements.

For instance, by analyzing historical volume profiles, I can pinpoint areas of liquidity that may serve as viable entry or exit points. By utilizing the unique features of Bookmap, such as advanced order flow analysis, I can better capitalize on opportunities and implement strategies that align with my risk tolerance, ultimately transforming my approach to cryptocurrency trading.

Bookmap: Frequently Asked Questions

What is Bookmap Trading Software?

- Bookmap Trading Software is a powerful trading platform that utilizes innovative visualization tools to help traders make informed and strategic decisions in the markets.

How does it work?

- Bookmap Trading Software uses advanced algorithms and data analysis to decode market movements and display them in an easy-to-understand visual format. This allows traders to see the order book, market depth, and trading activity in real-time.

What makes Bookmap unique?

- Bookmap is unique because it offers a depth of market visualization that is not available in traditional trading platforms. It also offers advanced features such as order flow analysis and historical data replay.

Suitable for beginners?

- While Bookmap Software is a powerful tool, it may not be the most user-friendly for beginners. However, it offers resources and educational materials to help users learn how to use the platform effectively.

Can the software be used for any market?

- Yes, Bookmap Trading can be used for trading in any market, including stocks, futures, options, and forex. Its advanced features and customizable settings make it a versatile tool for all types of traders.

Is Bookmap Trading Software worth the cost?

- This ultimately depends on your individual trading needs and preferences. Bookmap Trading Software offers a free trial for users to test out the platform and see if it is a good fit for their trading style before making a purchase.

See a more detailed review about bookmap trading software here.

> Recommended: brokerage for trading > tastytrade.com.

> Recommended: order flow heatmap > bookmap.com.