ures trading can be like a tempting dessert at a buffet, an oh-so-sweet with the potential for significant returns but packed with risks that could leave you regretting that second helping. Among the many firms that roll out the red carpet for aspiring traders, best prop trading firms like Apex and Topstep are like the popular kids at school, always standing out in the crowd.

Who Wins “Best Prop Firms” Trophy

Let’s dive into what futures trading is all about, comparing the similarities and differences between Apex and Topstep—think of it as a friendly showdown. This article will break down how these firms operate, highlighting the benefits and limitations of each. By the end, you’ll have a better grip on which one might just be the perfect match for your trading dreams—because who doesn’t want a partner who’s just right?

What is Futures Trading?

Futures trading is my kind of financial fun—it’s like betting on the future without a crystal ball! I’m buying and selling contracts to snag an asset at some future date for a price that’s already set in stone.

It’s a clever way to hedge against market chaos or take a wild guess on where prices are headed. This strategy has made its way into various asset classes, from commodities to currencies and even indices, offering me a smorgasbord of opportunities for profit and a chance to keep my risk in check.

Who knew hedging could feel so much like playing the markets with a side of excitement?

What Are Funded Futures Trading Firms?

Apex Trader Funding and Topstep are like the VIP lounges of the futures trading world, offering platforms that make aspiring traders feel like they’ve just stumbled into a treasure chest of opportunities.

With their proprietary trading setups and funding options, it’s like they’re saying, “Come on in, let’s see what you’ve got!” Plus, their evaluation programs are designed to help traders level up, whether you’re just starting or you’ve been around the trading block a few times.

It’s a structured environment where traders can flex their skills and access the resources and capital they need to turn their trading dreams into reality.

The Similarities

They are like two peas in a trading pod, both sharing a knack for futures trading that’s hard to ignore. They’re committed to rolling out robust trading platforms that not only give me market access but also throw in a generous helping of trader support through their thorough evaluation criteria.

They are like two peas in a trading pod, both sharing a knack for futures trading that’s hard to ignore. They’re committed to rolling out robust trading platforms that not only give me market access but also throw in a generous helping of trader support through their thorough evaluation criteria.

It’s all about enabling us traders with slick tools and educational goodies to level up our game.

Their platforms are as user-friendly as a favorite coffee shop, yet they pack some serious heat with sophisticated charting capabilities and a smorgasbord of order types. This means I can execute my strategies with the precision of a surgeon—minus the scrubs and anesthesia, of course.

The support from both firms is like having a personal trading cheer squad, complete with extensive coaching and live trading sessions that spice up the whole trader experience. And let’s not forget the treasure trove of educational resources they offer!

From trading fundamentals to risk management strategies and market analysis techniques, they make sure I’m armed and ready to make smart decisions.

From trading fundamentals to risk management strategies and market analysis techniques, they make sure I’m armed and ready to make smart decisions.

By honing in on these key areas, they cultivate a community that’s all about continuous learning and sharpening those trading skills. It’s like being part of a trading boot camp where everyone’s cheering each other on to greatness!

Key Differences between Apex vs Topstep

- Apex trader and Topstep might look like they’re twins separated at birth, but trust me, there are some pretty big differences in their trading rules, profit-sharing models, and payout structures that can shake up a trader’s experience and profitability.

- Traders like me must get the lowdown on these nuances before deciding which firm to roll with. Each company has its, flair to cater to different trading styles and goals.

- Take Apex, for example. They’ve got a pretty straightforward evaluation program that lets traders strut their stuff and prove their skills within a set time-frame. Meanwhile, Topstep prefers to take the scenic route with a more comprehensive assessment that often involves multiple phases—it’s like a trading obstacle course!

- This difference can change the game when it comes to the time and effort needed to snag that funded trading status. And let’s not forget the payout structures!

- Apex usually keeps it simple with a straight profit-sharing ratio, while Topstep likes to spice things up with incentives that can vary based on performance metrics.

- These variations can have some serious implications on how traders like me manage risk and make the most of our strategies, ultimately impacting both our short-term earnings and long-term growth. So, it’s all about doing the homework before diving in!

The Entry Process

These futures trading prop firms are like the ultimate boot camps for aspiring traders, giving them all the tools and platforms they need to strut their stuff.

They let me show off my trading chops through a series of evaluation processes that check out my performance metrics, risk management wizardry, and trading discipline—everything that screams, “I can handle an account without losing my shirt!”

This whole setup means I could potentially snag a funded account based on my dazzling display of skills. Who knew trading could feel like a talent show?

Requirements to Join

Joining these top futures prop firms isn’t just a stroll in the park; it’s more like an obstacle course for aspiring traders. I’ve got to meet certain requirements, which include diving into evaluation programs that put my trading objectives, discipline, and risk tolerance under the microscope.

It’s all about keeping me accountable on this wild trading ride. These prerequisites are like my trading boot camp, prepping me for the fierce competition in the futures trading arena.

As I jump into these programs, I find myself tested on my ability to whip up strategic trading plans and stick to my risk management protocols like they’re my favorite recipes. Communication skills? Oh, they’re a must! I have to explain my decision-making process clearly and show that I know my way around market dynamics.

Both prop firms make it crystal clear that continuous learning is the name of the game. They expect me to stay on my toes with ongoing education about market trends and trading strategies.

In the end, all of this helps create a culture of accountability, and let’s be honest, that’s the secret sauce for long-term success in this trading adventure.

Application Process

- The application process for these funded prop firms is like a smooth ride on glass of trading, designed to get new traders on board while dropping some serious knowledge about the nuances of futures trading.

- First up, I submit my application, complete a few assessments, and voilà! I gain access to an abyss of educational materials to help me tackle those trading complexities like a pro.

- Once I hit send on that application, I find myself diving into a series of assessments that are basically like a pop quiz for my trading smarts and risk management skills. These assessments aren’t just a way to test my knowledge; they’re also a golden opportunity to learn, complete with feedback that helps sharpen my trading game.

- After I ace those evaluations, I’m rewarded with a VIP pass to a buffet of educational resources—think webinars, interactive courses, and trading simulators. These resources are my secret weapons, arming me with the strategies and insights I need to glide smoothly into the wild world of real trading.

What are the Benefits of Using A Prop Trading Company?

Using prop firms is like having a turbocharger for my futures trading experience. I get access to some seriously sophisticated trading platforms, rock-solid risk management strategies, and a support team that’s as dedicated as a puppy waiting for a treat, all geared toward helping me level up my trading game.

With these perks in my corner, my performance and profitability could be soaring to new heights—just call me the trading superhero!

1. Access to Professional Trading Platforms

- I’ve got to say, that both Apex and Topstep prop firms are like the Swiss Army knives of the trading world, giving me access to professional trading platforms that are packed with all the market access and trading tools I need to pull off my strategies like a pro.

- These platforms are like chameleons, catering to all sorts of trading styles and strategies, which amps up my overall trading performance.

- With advanced charting capabilities, real-time market data, and customizable layouts, I can make my trading experience as personal as my morning coffee—just the way I like it!

- Plus, they play nicely with various trading algorithms, letting me execute trades faster than you can say “market opportunity.”

- And let’s not forget the cherry on top: enhanced risk management features like built-in stop-loss and take-profit orders. It’s like having a safety net while I juggle my portfolio!

- With a diverse range of asset classes and liquidity options, these platforms enable me to spread my investments and stay nimble in the ever-changing market landscape. Who knew trading could be this much fun?

2. Risk Management and Support

- Effective risk management and solid trader support are the bread and butter of what I get from these prop firms. They’re like my trusty sidekicks, helping me protect my capital and navigate futures trading while keeping my trading psychology in check. It’s like having a personal trainer for my trading brain!

- With their all-encompassing strategies that cover everything from risk assessment to position sizing and building psychological muscle, they create a thriving environment for traders like me. It’s a bit like a boot camp, but instead of crunches, I’m crunching numbers and strategies.

- Prop firms like Apex and Topstep get that emotional discipline is just as vital as knowing my charts inside out. That’s why they offer educational resources and mentorship programs that boost my confidence and hold me accountable.

- This one-two punch not only helps me safeguard my capital but also arms me with the mental frameworks I need to perform like a champ in those wild, volatile markets. So when I’m working with these platforms, I’m not just hoping for the best; I’m setting myself up to make informed decisions and, fingers crossed, score some winning trades!

3. Opportunity for Funding and Profit Sharing

- Apex and Topstep roll out the red carpet for traders like me, offering unique opportunities for funding and profit sharing. It’s like a VIP pass where I can leverage my trading skills to snag funded accounts while reaping the rewards from my successful trades. Talk about a win-win!

- This setup gives me all the motivation I need to shine while keeping my risk management skills sharp.

- Both prop firms know how to lure talented traders by setting up structured evaluations that put our trading skills and discipline under the microscope. With Apex, I get to strut my stuff in a simulated environment before being handed a funded account. It’s like a test drive without the financial risk—perfect for honing my profitability game.

- Topstep, on the other hand, plays it smart by tailoring its funding criteria to match my risk management strategies and performance metrics. Plus, the transparent profit-sharing arrangements mean I get to pocket a good chunk of the profits I generate.

- It’s like having a partner in crime, motivating me to go for the long haul and achieve that sweet success.

Limitations of Propfirm Trading

Even the best futures prop firms come with a shiny set of advantages, but let’s not kid ourselves; they’ve got their fair share of quirks.

We’re talking about monthly fees that can sneak up on you like a cat at midnight, strict trading rules that feel a bit like being sent to the principal’s office, and performance requirements that can turn your trading journey into an obstacle course.

So, it’s pretty important for me (and any trader, really) to grasp these limitations if I want to make savvy decisions about my futures trading adventure.

1. Monthly Fees and Subscription Costs

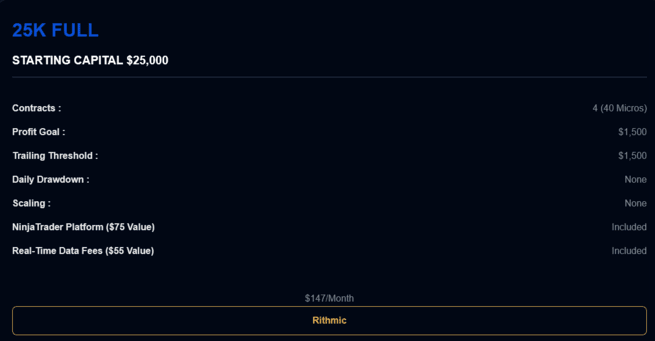

* Apex prices subject to change.

One of the biggest buzzkills about futures prop firms is those pesky monthly fees and subscription costs that can put a dent in a trader’s budget and profitability. It’s like trying to enjoy a gourmet meal but finding out you have to pay extra for the side of fries. And guess what? The costs can vary widely depending on the different programs each firm throws into the mix.

For many traders—especially the newbies just dipping their toes in the water—these recurring expenses can quickly drain their capital. So, it’s vital to keep these fees in mind while crafting a smart budgeting strategy.

When traders start pondering their long-term profit potential, they need to weigh those monthly bills against the sweet returns they hope to rake in from their trading escapades. Plus, the mental load of those recurring fees can turn even the boldest trader into a cautious cat.

That’s why it’s super important for traders to do their homework, comparing these platforms and figuring out how the financial commitment aligns with their personal trading goals and styles. After all, nobody wants to break the bank just to play the markets!

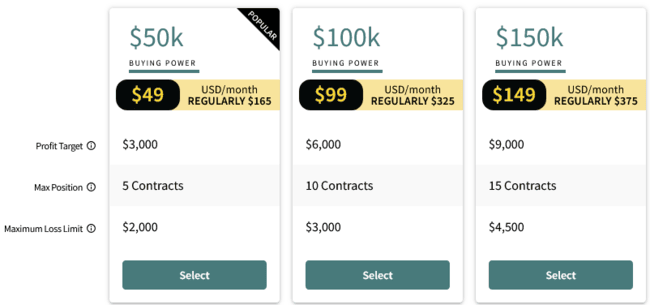

* Topstep prices subject to change.

2. Strict Rules and Performance Requirements

Apex and Topstep have their strict rules and performance requirements, which can feel like a double-edged sword; sure, they whip me into shape and promote trading discipline, but they can also crank up the pressure and stress—especially when I’m struggling to meet those lofty expectations. It’s like trying to juggle flaming torches while riding a unicycle! Understanding these rules is crucial if I want to succeed long-term.

For many traders like me, these guidelines are like a trusty map in the chaotic jungle of the markets, helping us develop a consistent approach. Sticking to these standards requires me to pay close attention to every tiny detail and sharpen my critical trade analysis skills, which is about as fun as watching paint dry.

But let’s be honest: this constant scrutiny can lead to anxiety. It’s tough when trying to hit the numbers starts to squelch my creativity and spontaneity in decision-making. So, I’ve got to find that sweet spot between embracing these requirements for self-improvement and managing the stress they bring along.

Balancing these aspects is key because they can dramatically shape my performance and growth in this cutthroat trading arena.

3. Limited Trading Instruments and Strategies

One of the quirks of using Apex or Topstep is the somewhat limited buffet of trading instruments and strategies on offer. It’s like going to a restaurant with a fancy menu but only being allowed to order off the kids’ section. Not ideal for someone looking to spice things up based on market mood swings. This little limitation can shape how I approach trading.

When I can’t effectively diversify my strategies, it’s like walking a tightrope during a windstorm is not the best way to manage risk during those volatile moments. This limitation could ultimately affect my performance and long-term success in the wild world of trading.

Which Propfirm Trading Company Should You Choose

- Choosing between a propfirm trading company feels a bit like deciding between chocolate and vanilla—both are delicious, but it boils down to what tickles my trading fancy.

- Each firm has its own set of quirks and perks, but in the end, it’s all about aligning with my unique goals, risk appetite, and personal trading groove.

- I have to weigh factors like the available resources for traders, the funding options on the table, and the vibe of the trading environment each firm offers.

- It’s like picking the right dance partner for a tango – gotta make sure we’re in sync!

Factors to Consider

- When I’m caught in the Apex vs. Topstep showdown, I know I’ve got to weigh a few key factors—like my trading goals, risk tolerance, and those fancy trading strategies I’m itching to use. These elements can make or break my experience and success at either place.

- Figuring these out helps me tailor my choice to fit my unique needs, kind of like finding the perfect pizza topping combo.

- I also have to take a good look at my trading experience and how cozy I am with different platforms since that can affect how smoothly I pull the trigger on trades.

- Apex might be my jam if I’m craving a flexible account structure, while Topstep could be calling my name if I’m in the mood for a structured trading environment with specific challenges that make me feel like a trading warrior.

- And let’s not forget about those sneaky fee structures and commission rates, because who wants their profits gobbled up? By taking a moment to weigh all these aspects, I can make a savvy decision that aligns perfectly with my long-term trading dreams.

Frequently Asked Questions

Are Apex and Topstep Futures Trading Firms Funded?

- Apex and Topstep are both futures trading firms, but they have some key differences in their approach and offerings.

Main focus of Apex Futures?

- Apex Futures is primarily focused on providing a comprehensive trading platform for active futures traders, including advanced charting and technical analysis tools.

Main focus of Topstep?

- Topstep’s main focus is on providing a platform for beginner traders to gain experience and prove their skills through simulated trading challenges before funding a live trading account.

Differences in account types between Apex & Topstep?

- Apex offers traditional individual, joint, and corporate trading accounts, while Topstep offers a simulated trading account and a funded trading account program.

Minimum funding requirements for a funded trading account with Apex and Topstep?

- Apex has several monthly plans to choose from, the more you pay per month the more funded capital you have to trade with. Topstep has a similar program as well, both trading prop firms change their prices regularly due to competition between the both.

…And the winner is? Apex. Please refer to this review of Apex trader for details. Use their money for a small monthly fee.

Please share if you found this article helpful, thanks!

> Recommended: brokerage for trading > tastytrade.com.

> Recommended: order flow heatmap > bookmap.com.